The changing pace of the market brings new opportunities for New Homes Developers to adapt and grow in the long-term. Here’s the latest news and insight to help you do just that…

Opportunities to attract more buyers

The average asking price for new build properties has risen from £408,012 in January 2019 to £421,023 in January 2023 – a rise of 3.2%. During the same period, the average asking price for resale properties has risen from £300,447 to £360,976 – a much larger increase of 20.1%.

As a result, the gap between new build and resale asking prices was just 17% in January 2023 compared to 36% in January 20191. Could this smaller gap in asking prices tempt more buyers to choose new?

Our research shows that while 20% of buyers start their property search with a preference for new builds, a further 45% have no preference. That means 65% of the home buying audience on Rightmove are open to buying new2.

We also found that buyers searching for a new build property specifically, are more likely to enquire about properties over 50km from their current address, than those enquiring about resale properties3.

That means your marketing needs to work harder than ever to reach those out of area buyers. Your Rightmove Account Manager can use the Lead Mapping Report to see lead hotspots for your developments.

Sources: 1 – Rightmove data, average asking prices for New Build and Resale properties Jan 2019 compared to Jan 2023. 2 – Rightmove consumer survey 2020. 3 – Rightmove data November 2022

Buyer demand is returning to normal levels

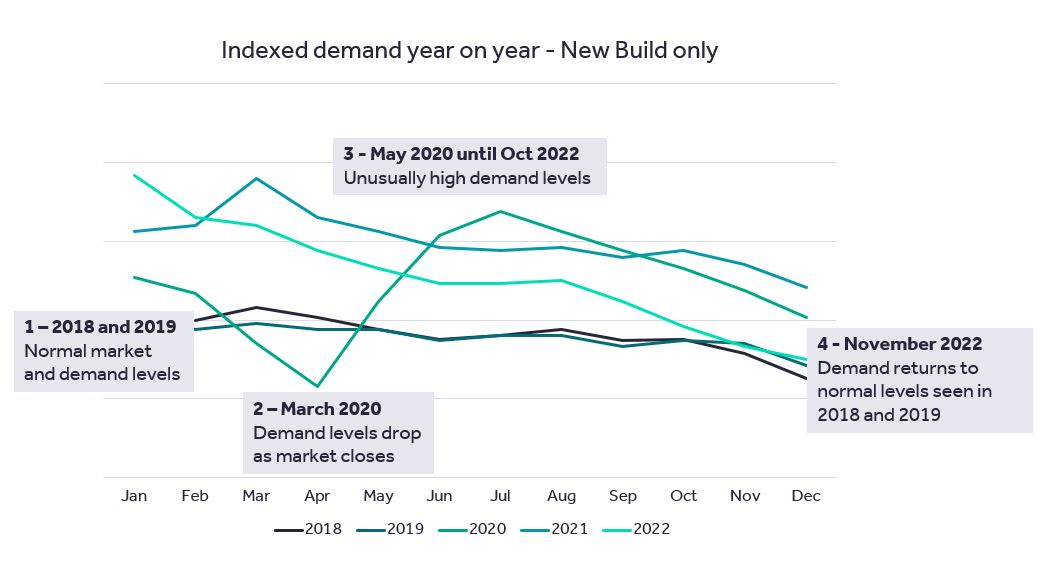

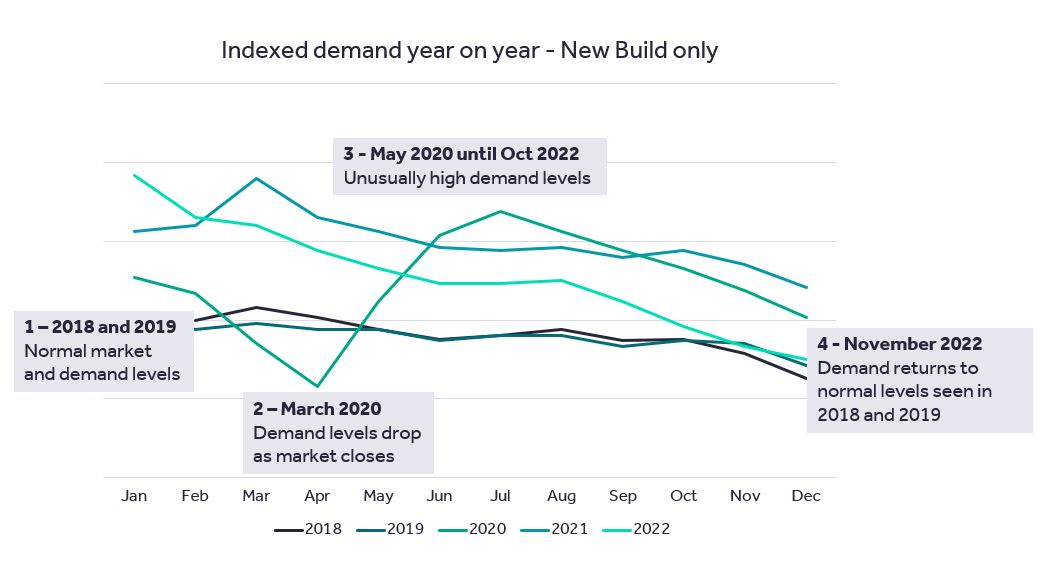

The closure of the property market in 2020, combined with a new list of requirements for many homeowners, meant buyer demand for property reached unprecedented levels in the second half of 2020 and into 2021 and 2022.

All that demand translated into record transactions – with almost 1.5 million property transactions in 2021 compared to just under 1.2 million in the more normal markets of 2018 and 20191. With those transactions now complete (and many more in progress) it’s no surprise that demand levels are moving back in line with 2018 and 2019’s levels2.

Your Account Manager can give you a localised view of the unique supply, demand and price dynamics for each of your developments to help you spot opportunities for the year ahead.

Sources: 1 – HMRC property transactions over £40,000 2018-2022. 2 – Rightmove data, enquiries sent to new build developers Feb 2018 – December 2022

What’s on the horizon?

Get ahead of the curve – click the titles below to read more.

With applications for Help to Buy ending in October 2022, New Homes Developers may be concerned about the impact on demand from First Time Buyers. However, our research shows that many would-be First Time Buyers are making lifestyle changes so they can save more towards a deposit.

Most common cost savings for First Time Buyers:

- Reducing spending on going out (72%)

- Using less gas and electricity at home (55%)

- Spending less on holidays (49%)

- Reducing how much they spend on a food shop (48%)

- Cancelling subscription services like Netflix and Amazon Prime (35%)

Read more here: How First Time Buyers are saving for a deposit

Want to attract more First Time Buyers? Speak to your Account Manager for ways Rightmove can help you reach them.

Mortgage rates started edging down towards the end of 2022. Even if the base rate goes up, mortgage rates are expected to keep going down.

The latest data shows that someone looking to take out a five-year fixed mortgage with a 15% deposit would now be looking at an average rate of 4.82%, compared with 5.90% in October.

“The mortgage market is now looking more positive compared to the last three months of 2022, which should give people more certainty and confidence ahead of the traditionally busy spring home-moving season…Lenders are competing for business and have been reducing their rates further.” says our mortgage expert Matt Smith.

Read more here: February’s interest rates update

The stamp duty changes announced in September’s mini-budget are due to remain in place until 2025. Towards the end of 2023 and moving into 2024 we might see heightened demand from homeowners and First Time Buyers looking to make the most of lower rates before they increase again in 2025.

One of the first places buyers visit when they’re thinking about moving is Rightmove. On average they spend 7-12-months researching on Rightmove before deciding they want to move. This is when they start their property search in earnest by visiting Rightmove daily. Their search then usually lasts around 6-months.

That gives you an 11–18-month window to influence those buyers with your brand marketing on Rightmove, before they make that all-important buying decision.

Source: Understanding Rightmove Users, February 2021

Unlock sales growth in 2023 with the 3 M’s – Market, Mix and Messaging…

1 – Market: Deep dive into each development’s unique property market

How are supply and demand impacting asking prices? Are you getting your fair share of buyer enquiries? What are the most popular property types in my area? Where are the lead hotspots…for you and your competitors?

Your Rightmove Account Manager can help you answer these questions – book a call with them below to get started.

2 – Marketing mix: Balance brand awareness with direct response for long-term sales growth

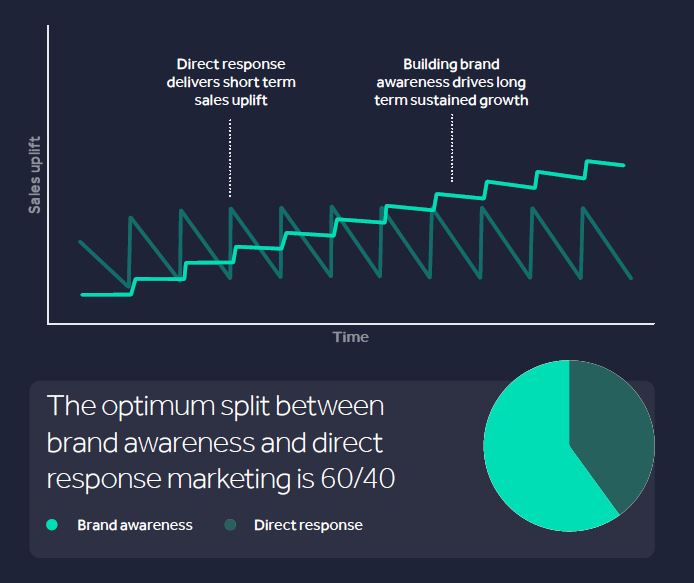

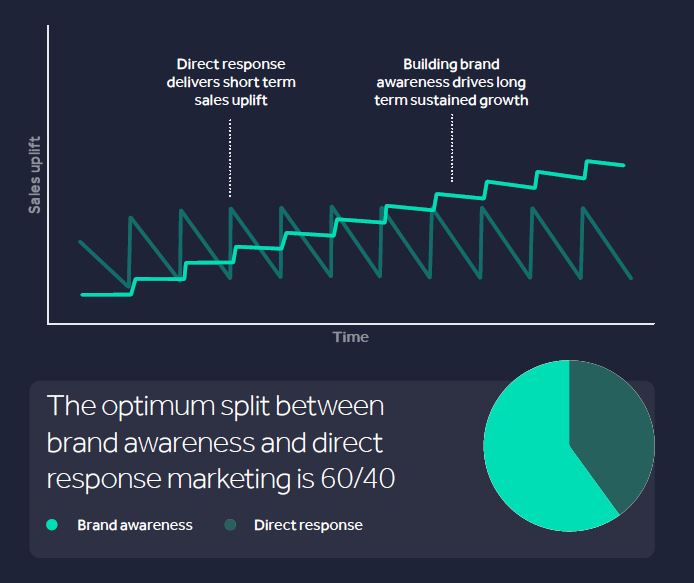

Studies have shown that direct response marketing creates short term sales uplift, while brand awareness drives long-term sales growth. On the graph below, the sharp peaks and troughs in sales conversion are created by direct response marketing. The more gradual increase is driven by brand awareness, which becomes most impactful from 6-months onwards.

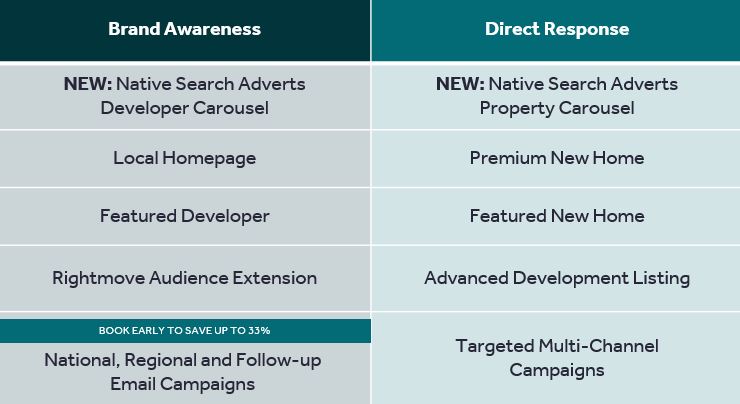

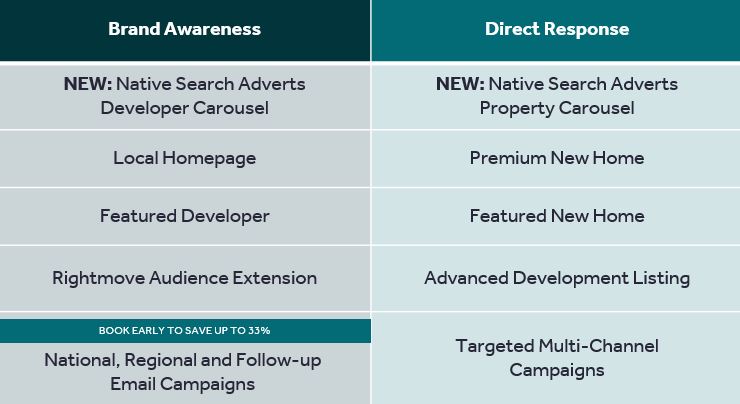

You can mix and match brand awareness and direct response marketing options targeted exclusively at Rightmove’s in-market audience:

View all Rightmove New Homes products

3 – Messaging: Tap into the latest buyer insights to increase appeal

Based on this article, some topics you might want to consider for your marketing messages are:

- Lower premiums to buy new

- Energy and cost efficiencies

- First Time Buyer incentives

- Stamp Duty savings

For brand awareness, which has a broad reach and influences buyers’ action further down the line, emotional messaging works best. For direct response, which is more tightly targeted and drives immediate action, persuasive messages are your best bet.

Get in touch

In a changing market it’s great to know there’s someone on your side. Your Rightmove Account Manager is here to help you every step of the way. Whatever you’d like to talk about, give them them a call or email, or request a call back using the form below if you don’t have their details to hand.