Commercial market update: November 2022

To help you cut through the negative headlines, here’s a factual view of what’s happened to commercial supply and demand in recent weeks.

As the UK’s biggest commercial property website, we’re uniquely placed to share data based on what’s being listed. We give you access to the most robust, real-time data in that you can rely on to plan for the future.

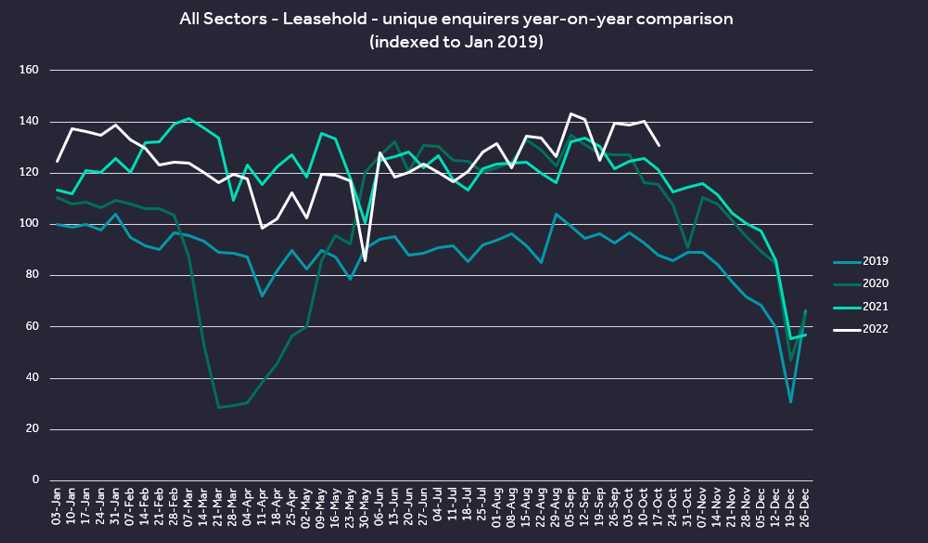

Leasehold demand is higher than at any point since February 2021

The number of unique people enquiring about commercial leasehold properties over the last four weeks is 11% higher than the same period last year. And 45% higher than the same period in 2019, the last “normal” pre-pandemic market.

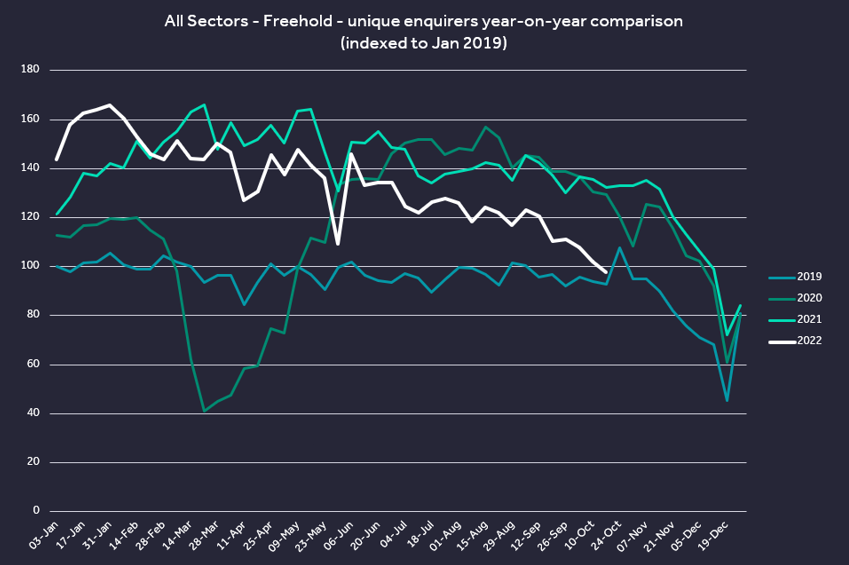

Freehold demand is softening but still above 2019

Compared to the same period in 2021, freehold demand over the last four weeks was 28% down. However, demand for freehold stock still remains 11% higher than the same period in 2019.

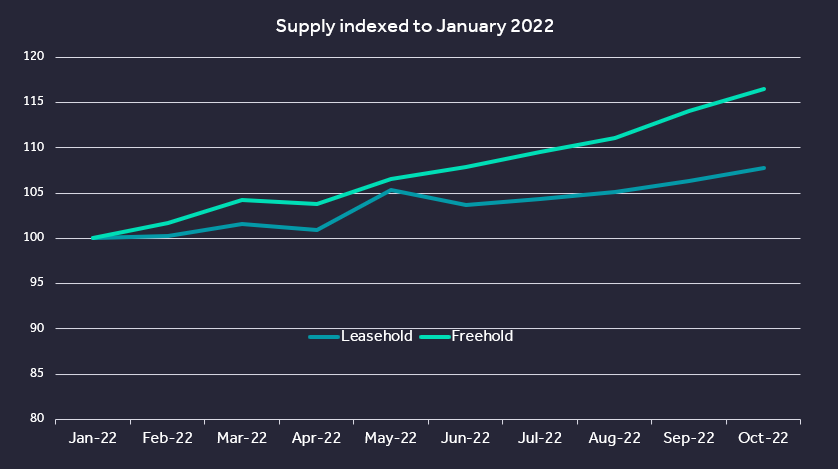

Supply is increasing, particularly in freehold

Supply of freehold stock increased 1% between September 2022 and October 2022. 17% more freehold properties came to market in October 2022 than January 2022.

Leasehold supply is also increasing, albeit at a slower rate. Month-on-month supply increased 1% between September and October 2022, with a 8% increase since January.

Sector snapshot

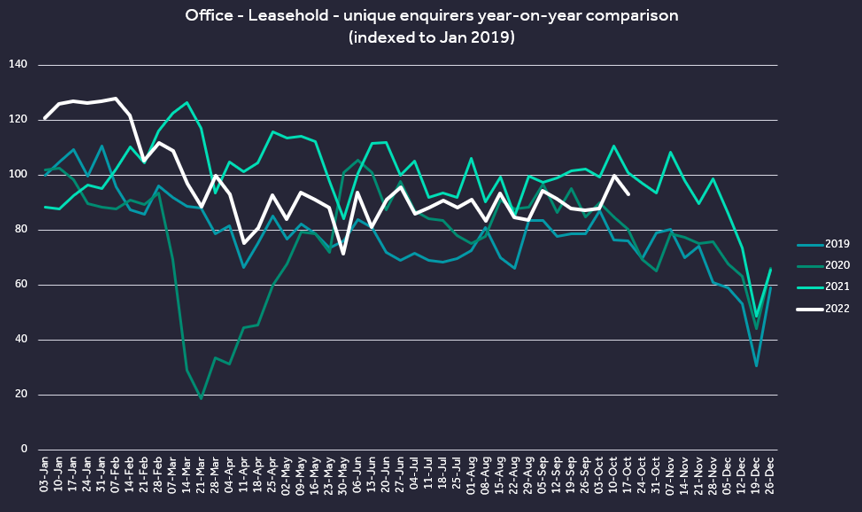

Office – Leasehold demand

In the four weeks since the mini budget, we saw 3% more people enquire about leasehold office stock than the previous four weeks.

We’ve observed higher volumes of leasehold office enquiries in the last two weeks than in any two week period this year since March.

Overall, leasehold office demand over the last 4 weeks was 11% down on the record demand we saw in 2021 but was 15% higher than 2019 levels. In the flexible office space, leasehold demand is 32% down on the same period in 2021 but still 44% higher than 2019.

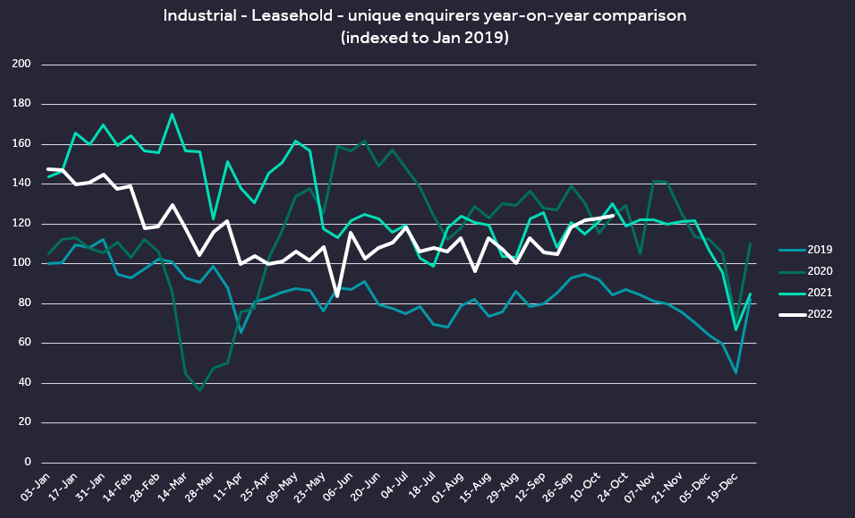

Industrial – Leasehold demand

Despite the ongoing challenges faced by supply chains, demand for leasehold industrial and warehouse stock remains strong.

In the four weeks since the mini budget, 15% more people enquired about leasehold industrial stock than in the previous four weeks.

We saw higher volumes of leasehold industrial enquiries in the first three weeks of October than in any week this year since March.

Overall, the number of people enquiring about leasehold industrial stock over the last four weeks remains 33% higher than 2019 levels, and is the same as we saw in 2021.

Want to see this data at a more local level, or for more sectors?

Your Rightmove Commercial Account Manager can take you through this data at a more granular level, across the regions and sectors that matter most to you.

Not currently your commercial properties to the UK’s biggest commercial audience?