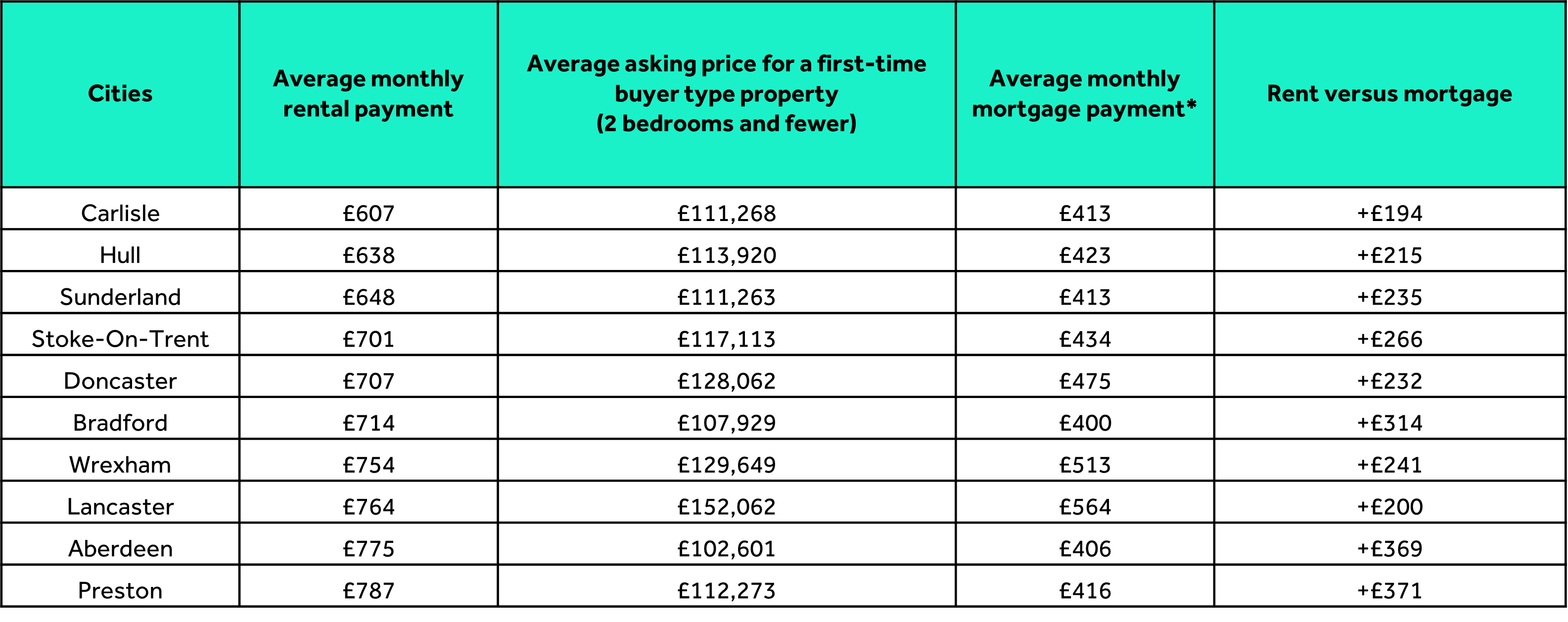

10 cheapest cities to rent in Britain

Carlisle is the cheapest city to be a renter

New analysis has revealed Carlisle is the cheapest city in Britain to be a renter, with the average advertised rent for an equivalent two-bedroom or smaller property now £607 per month.

In contrast, Oxford is the most expensive city outside of London to be a renter, with an average two-bedroom or smaller home currently advertised at £1,561 per month.

This study, which focused on first-time buyer type properties (2 bedrooms or less), analysed both the average monthly rents and average monthly mortgage payments in the largest cities across Britain.

Data from UK Finance shows that the average deposit size in Scotland and Wales is 20%, while in England it is 25%, and that more first-time buyers are choosing longer repayment terms to improve their affordability. Average monthly mortgage payments were calculated on this basis in this study.

10 cheapest cities to be a renter

*Monthly mortgage payment figures assumes first-time buyers in Scotland and Wales have a 20% deposit, and first-time buyers in England have a 25% deposit, based on UK Finance Data on first-time buyer mortgage trends. Repayment is over 35 years.

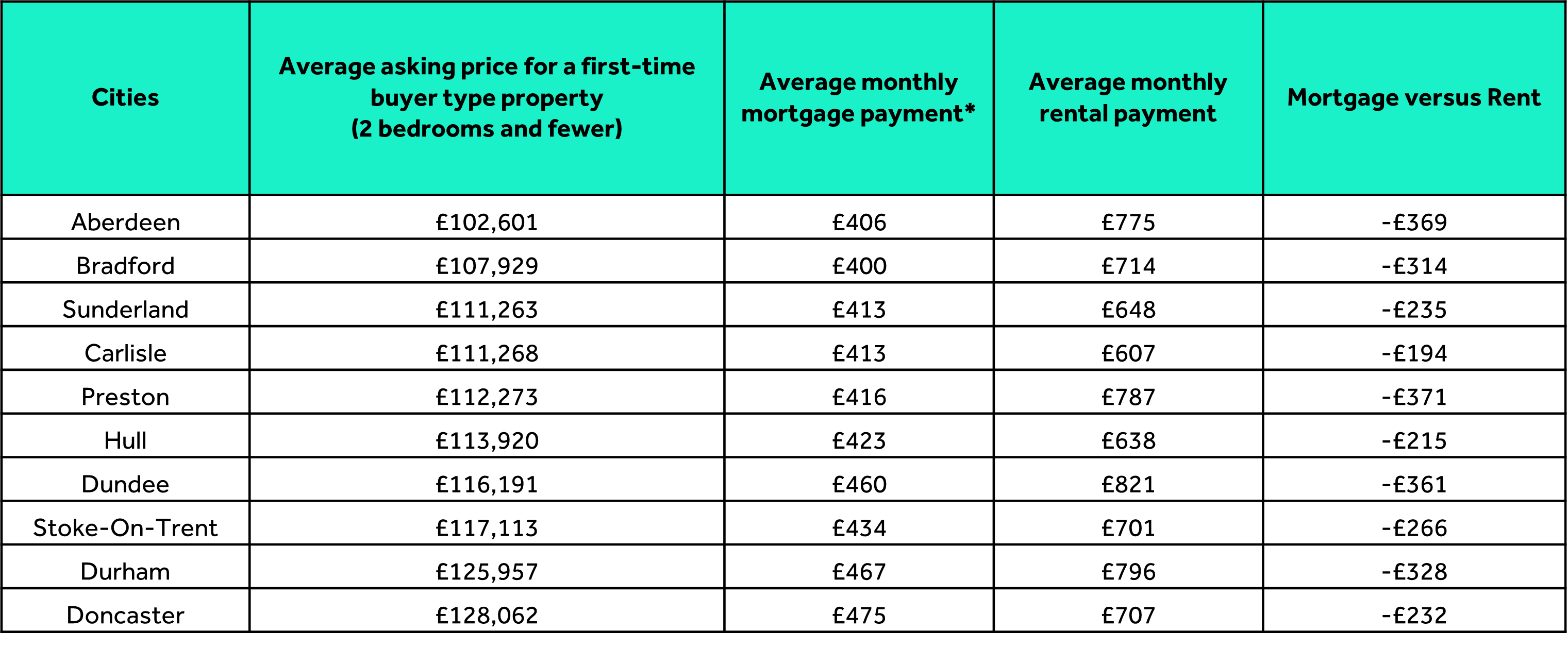

The average asking price for a typical first-time buyer type property (two bedrooms or fewer) in Aberdeen is currently £102,602, with the average monthly mortgage payment now £406 per month.

The average monthly mortgage payment assumes a buyer in Aberdeen has a 20% deposit and has chosen to repay their mortgage over the course of 35 years, at the current average five-year fixed mortgage rate of 4.84%.

Data from UK Finance shows that the average deposit size in Scotland and Wales is 20%, while in England it is 25%, and that more first-time buyers are choosing longer repayment terms to improve their affordability.

Bradford is the second cheapest city to be a first-time buyer, with an average asking price of £107,929, and Sunderland is the third cheapest, at £111,263.

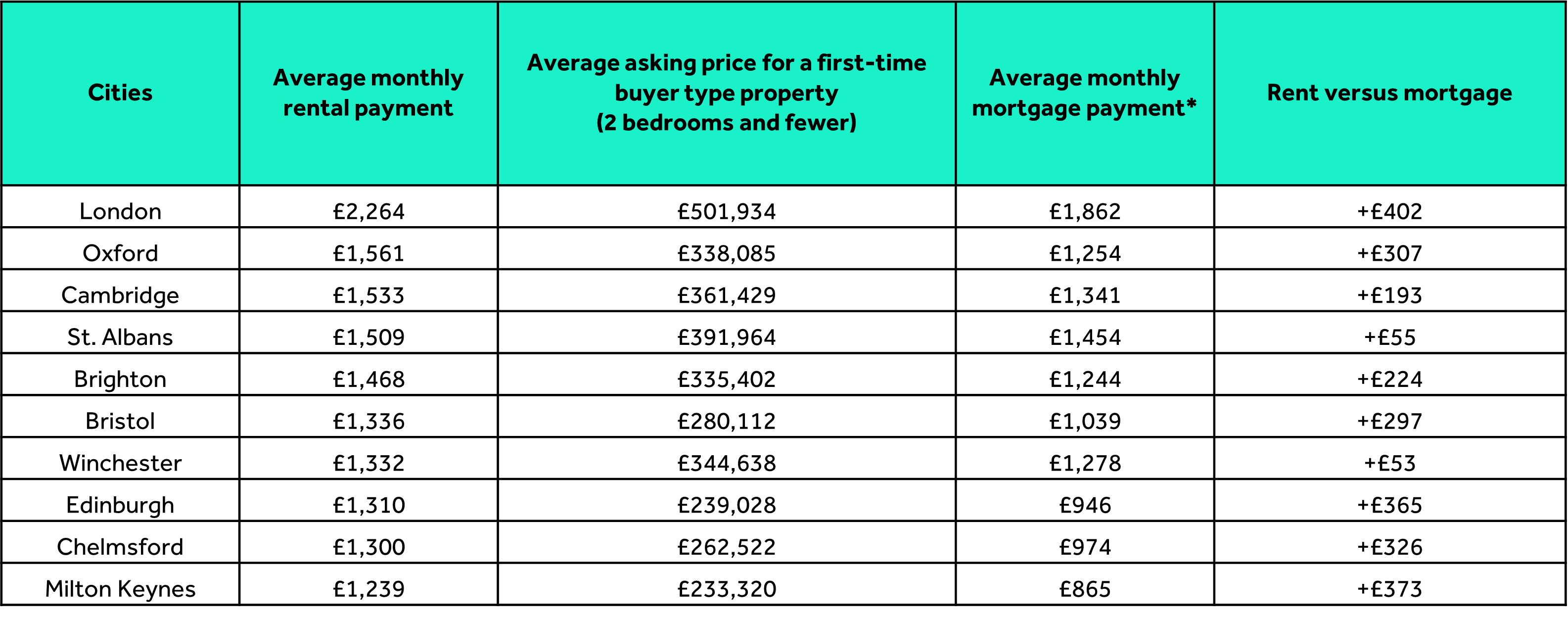

10 most expensive cities to be a renter

*Monthly mortgage payment figures assumes first-time buyers in Scotland and Wales have a 20% deposit, and first-time buyers in England have a 25% deposit, based on UK Finance Data on first-time buyer mortgage trends. Repayment is over 35 years.

Renting vs buying

The average monthly mortgage payment for a typical first-time buyer type property in Great Britain (two bedrooms and fewer) is £53 more than this time last year, vs £81 for renters.

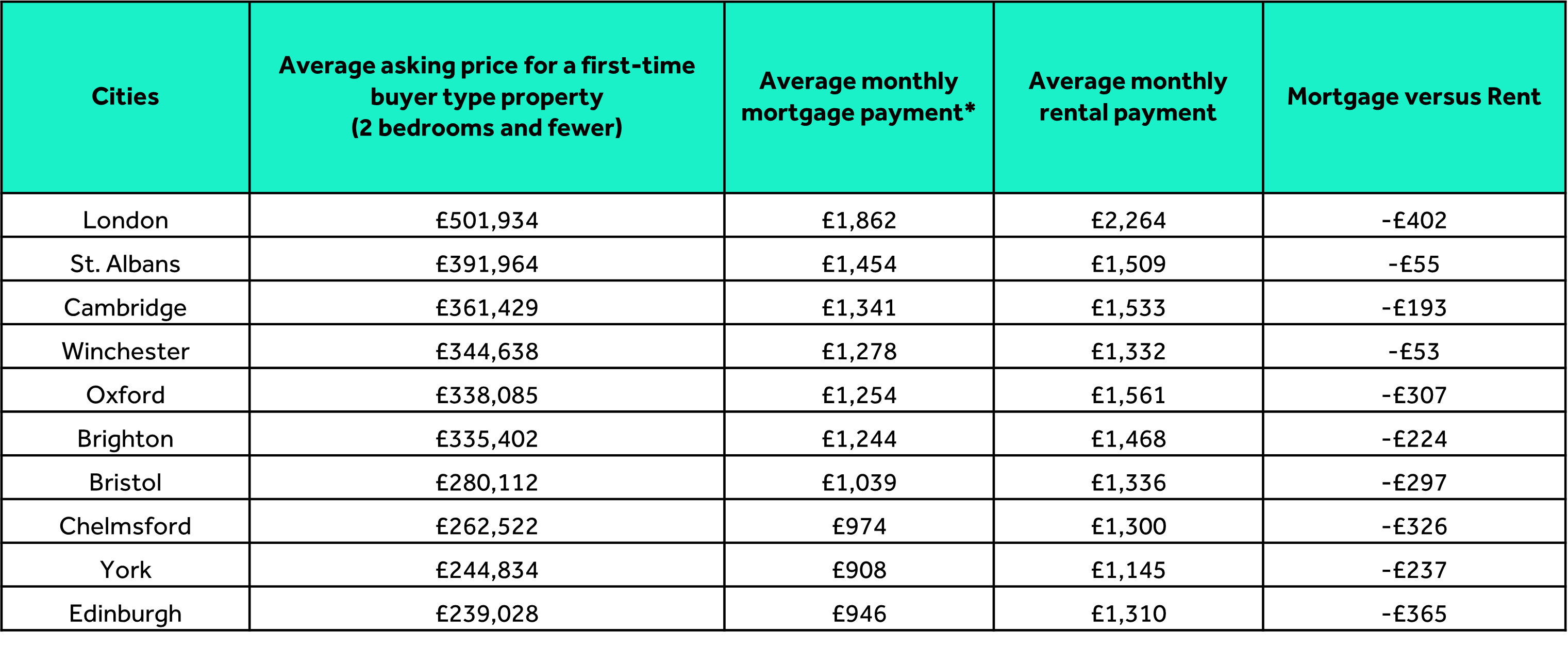

For those who have been able to save up the average deposit of 20% or 25%, it is cheaper to pay a monthly mortgage than rent in each of Great Britain’s largest cities, as well as the capital.

The cost of renting a two-bedroom or smaller home has increased by 39% in the last five years, versus a 19% jump in the cost of buying a two-bedroom or smaller home.

Even if a first-time buyer had a smaller 15% deposit and wanted to repay their mortgage over 25 years rather than 35 years, it would still be cheaper to pay a mortgage than rent in 39 out of Britain’s 50 largest cities outside of London.

10 cheapest cities to be a first-time buyer

*Monthly mortgage payment figures assumes first-time buyers in Scotland and Wales have a 20% deposit, and first-time buyers in England have a 25% deposit, based on UK Finance Data on first-time buyer mortgage trends. Repayment is over 35 years.

10 most expensive cities to be a first-time buyer

*Monthly mortgage payment figures assumes first-time buyers in Scotland and Wales have a 20% deposit, and first-time buyers in England have a 25% deposit, based on UK Finance Data on first-time buyer mortgage trends. Repayment is over 35 years.

Notes:

- First-time buyer type properties refers to 2 bedrooms and fewer properties.

- The data analysed more than 50 cities across Great Britain.

- The data assumes first-time buyers in Scotland and Wales are taking out a five-year fixed, 80% Loan-to-Value (LTV) mortgage at the average 5-year rate of 4.84%, spread over 35 years. Rate taken from 17th April 2024.

- The data assumes first-time buyers in England are taking out a five-year fixed, 75% Loan-to-Value (LTV) mortgage at the average 5-year rate of 4.84%, spread over 35 years. Rate taken from 17th April 2024.

- Average mortgage rates to be credited to Rightmove. The data is provided by specialist mortgage technology provider Podium Solutions. The data covers 95% of mortgage lending, to exclude specialist lenders. All rates are based on products with a circa £999 fee. If you would like further data on different LTVs or fixed terms, please contact us.

Rental Price Tracker

Our quarterly update on the latest stats, insight and trends for the British rental market.

Rental tracker